The cryptocurrency bubble has burst.

In January, the total market capitalisation of cryptocurrencies had climbed beyond $800bn, up from just $18bn a year earlier according to data provider CoinMarketCap. Now the market has lost three-quarters of its value to stand at $200bn.

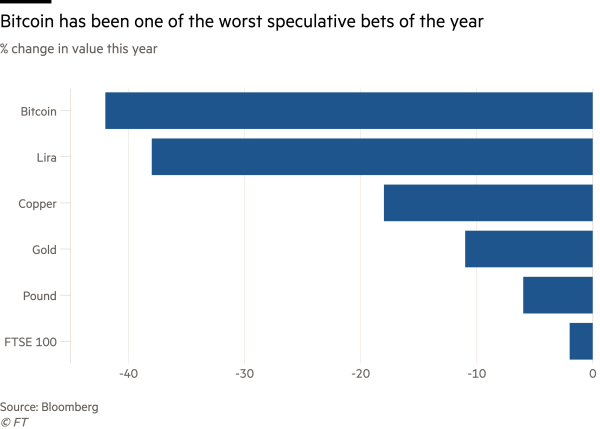

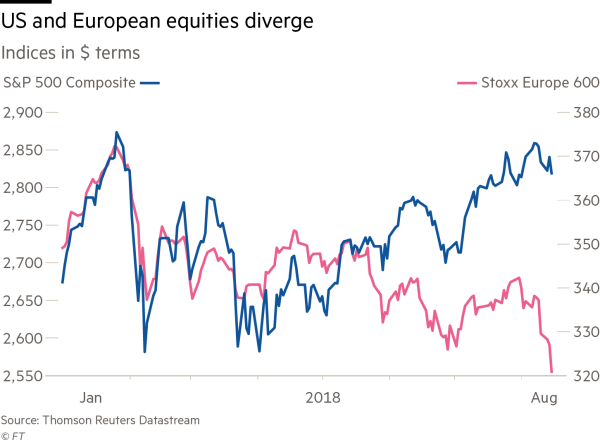

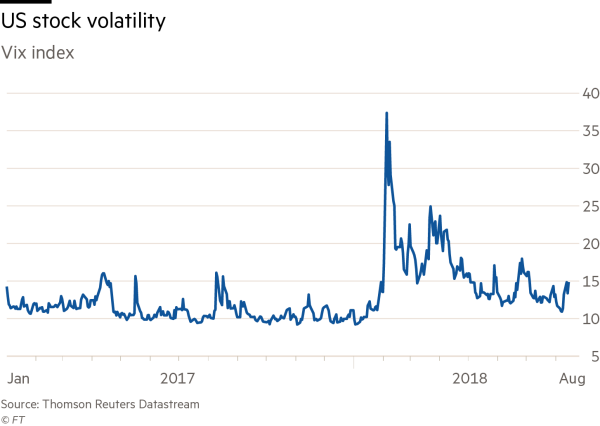

The shrinking market value of the novel digital assets comes alongside rising volatility in mainstream financial markets such as equities, offering traders other opportunities to profit on fluctuating asset prices.

“The hype has gone, the punters and trader types have gone,” said Simon Taylor, a former Barclays VP and co-founder at financial technology consultancy 11:FS.

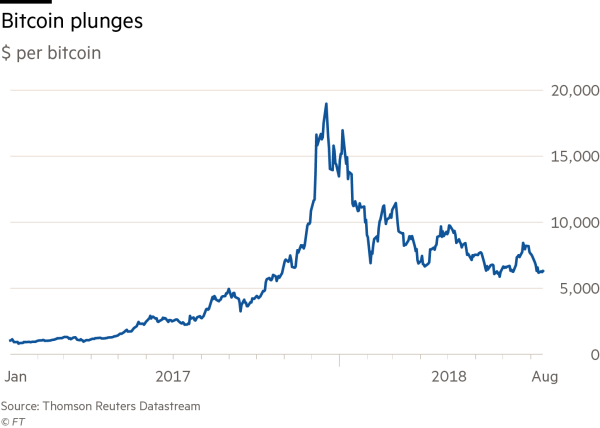

Bitcoin, the original and most valuable cryptocurrency, has plummeted from $19,000 in December to bump along at a $6,000-$8,000 range since June. Advocates see bitcoin, which unlike fiat currencies is not controlled by a central authority, as a store of value. But its short history has been marked by rapid rallies and sharp drops.

Scott Weiss, an Arizona lawyer, bought his first bitcoin at its highest price in December. “I’m not a professional investor, I’m a lawyer,” he said, reflecting on his losses. “These are the types of mistakes we make. We get caught up in the hype.” He is resolutely holding.

Mr Weiss is not alone. Most cryptocurrency advocates still exude optimism. Trading platform eToro, known for bold cryptocurrency adverts on the London Underground, is not scaling back its marketing despite the slump, said Iqbal Gandham, Etoro’s managing director.

Jordan Fried, vice-president of global business development at blockchain start-up Hedera Hashgraph, which raised $100m from institutional investors, said the speculative rush had provided some legitimate early stage companies with capital to build services to sustain the nascent cryptocurrency industry.

“A lot of it paid for frat boy entrepreneurs to take private jets to Mykonos,” he said. “But it’s helping us to build an infrastructure.”

But many of the features of the boom days are struggling. Attempts to open exchange traded funds for bitcoin, which cryptocurrency proponents hope would be a key step towards wider adoption, have so far been met with a cold shoulder by US regulators. The Winklevoss twins, early Facebook investors who run cryptocurrency exchange Gemini, were among those rebuffed.

In the City of London, the online retail trading industry, whose profits had fallen in becalmed stock markets last year, seized on volatility of better-known digital assets like bitcoin and ether, its closest rival. Offering crypto-based derivatives and charging punters hefty fees to trade them, many profited handsomely. Plus500 reported a 418 per cent year-on-year rise in earnings in the first quarter of 2018, citing “high levels of interest” in its cryptocurrency products.

Both Plus500 and FTSE 250 trading company IG acknowledge cryptocurrency trading interest has now waned. “Bust is the word,” said Peter Hetherington, IG’s chief executive.

With prices tumbling, bitcoin investors have retreated to holding, suggests research by Unchained Capital, a start-up which lends cash against cryptocurrency.

Bitcoin’s slide coincided with the introduction of bitcoin futures contracts by the CME Group and Cboe Global Markets, which provided crypto investors with a hedging opportunity for the first time while also allowing traders to bet the price of bitcoin would fall.

The demise of once ferociously traded new digital coins from 2017, with names like DentaCoin and SpankChain, also sucked money from the overheated market.

Entrepreneurs had created hundreds of tokens in so-called “ initial coin offerings” (ICOs), barely regulated fundraising vehicles that unlocked pools of money mostly held by retail investors — an attractive proposition for both early stage entrepreneurs and get rich quick schemers. “Who doesn’t want to print free money?” remarked Michel Rauchs, blockchain and cryptocurrency lead at Cambridge university’s Centre for Alternative Finance.

Telegram, the messaging app, raised a record $1.6bn in cash from investors to fund development of its own cryptocurrency.

While tokens offer no investor protection, many punters enjoyed rapid appreciation of their crypto holdings as others piled in. Groups of traders co-ordinated to pump the price of thinly traded coins and profited by selling them at artificially high prices. By early January, the height of cryptocurrency fever, at least 39 digital currencies had market capitalisations of $1bn or more.

“Now we’ve realised that a lot of these tokens don’t power any useful application, and if they do there’s only a handful of users,” said Mr Rauchs. As speculative mania has dimmed, just 15 coins currently have a $1bn-plus market cap, according to CoinMarketCap. DeadCoins.com lists abandoned tokens

“The days of investing in an ICO and getting 75x on it in six months are gone,” said Ari Lewis, who opened cryptocurrency hedge fund Grasshopper Capital in August 2017.

One investor with personal cryptocurrency holdings worth tens of millions of dollars said that while he was continuing to buy and hold bitcoin, he had jettisoned coins which were popular trades last year, including XRP, the third largest.

Source: Financial times

In January, the total market capitalisation of cryptocurrencies had climbed beyond $800bn, up from just $18bn a year earlier according to data provider CoinMarketCap. Now the market has lost three-quarters of its value to stand at $200bn.

The shrinking market value of the novel digital assets comes alongside rising volatility in mainstream financial markets such as equities, offering traders other opportunities to profit on fluctuating asset prices.

“The hype has gone, the punters and trader types have gone,” said Simon Taylor, a former Barclays VP and co-founder at financial technology consultancy 11:FS.

Bitcoin, the original and most valuable cryptocurrency, has plummeted from $19,000 in December to bump along at a $6,000-$8,000 range since June. Advocates see bitcoin, which unlike fiat currencies is not controlled by a central authority, as a store of value. But its short history has been marked by rapid rallies and sharp drops.

Scott Weiss, an Arizona lawyer, bought his first bitcoin at its highest price in December. “I’m not a professional investor, I’m a lawyer,” he said, reflecting on his losses. “These are the types of mistakes we make. We get caught up in the hype.” He is resolutely holding.

Mr Weiss is not alone. Most cryptocurrency advocates still exude optimism. Trading platform eToro, known for bold cryptocurrency adverts on the London Underground, is not scaling back its marketing despite the slump, said Iqbal Gandham, Etoro’s managing director.

Jordan Fried, vice-president of global business development at blockchain start-up Hedera Hashgraph, which raised $100m from institutional investors, said the speculative rush had provided some legitimate early stage companies with capital to build services to sustain the nascent cryptocurrency industry.

“A lot of it paid for frat boy entrepreneurs to take private jets to Mykonos,” he said. “But it’s helping us to build an infrastructure.”

But many of the features of the boom days are struggling. Attempts to open exchange traded funds for bitcoin, which cryptocurrency proponents hope would be a key step towards wider adoption, have so far been met with a cold shoulder by US regulators. The Winklevoss twins, early Facebook investors who run cryptocurrency exchange Gemini, were among those rebuffed.

In the City of London, the online retail trading industry, whose profits had fallen in becalmed stock markets last year, seized on volatility of better-known digital assets like bitcoin and ether, its closest rival. Offering crypto-based derivatives and charging punters hefty fees to trade them, many profited handsomely. Plus500 reported a 418 per cent year-on-year rise in earnings in the first quarter of 2018, citing “high levels of interest” in its cryptocurrency products.

Both Plus500 and FTSE 250 trading company IG acknowledge cryptocurrency trading interest has now waned. “Bust is the word,” said Peter Hetherington, IG’s chief executive.

With prices tumbling, bitcoin investors have retreated to holding, suggests research by Unchained Capital, a start-up which lends cash against cryptocurrency.

Bitcoin’s slide coincided with the introduction of bitcoin futures contracts by the CME Group and Cboe Global Markets, which provided crypto investors with a hedging opportunity for the first time while also allowing traders to bet the price of bitcoin would fall.

The demise of once ferociously traded new digital coins from 2017, with names like DentaCoin and SpankChain, also sucked money from the overheated market.

Entrepreneurs had created hundreds of tokens in so-called “ initial coin offerings” (ICOs), barely regulated fundraising vehicles that unlocked pools of money mostly held by retail investors — an attractive proposition for both early stage entrepreneurs and get rich quick schemers. “Who doesn’t want to print free money?” remarked Michel Rauchs, blockchain and cryptocurrency lead at Cambridge university’s Centre for Alternative Finance.

Telegram, the messaging app, raised a record $1.6bn in cash from investors to fund development of its own cryptocurrency.

While tokens offer no investor protection, many punters enjoyed rapid appreciation of their crypto holdings as others piled in. Groups of traders co-ordinated to pump the price of thinly traded coins and profited by selling them at artificially high prices. By early January, the height of cryptocurrency fever, at least 39 digital currencies had market capitalisations of $1bn or more.

“Now we’ve realised that a lot of these tokens don’t power any useful application, and if they do there’s only a handful of users,” said Mr Rauchs. As speculative mania has dimmed, just 15 coins currently have a $1bn-plus market cap, according to CoinMarketCap. DeadCoins.com lists abandoned tokens

“The days of investing in an ICO and getting 75x on it in six months are gone,” said Ari Lewis, who opened cryptocurrency hedge fund Grasshopper Capital in August 2017.

One investor with personal cryptocurrency holdings worth tens of millions of dollars said that while he was continuing to buy and hold bitcoin, he had jettisoned coins which were popular trades last year, including XRP, the third largest.

Source: Financial times