I don't know much about finance but I think money is a representation of trust. If you have something of value you could barter it to get something else but in a functioning society with institutions you trade something of value for what would essentially be valueless without trust. When this circulates through an economy quickly it allows for resources to be exchanged rapidly and for development to take place.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Thoughts on money creation

- Thread starter Nilotic

- Start date

Nilotic

VIP

@Nilotic theres also something called seignorage which is the real value that US government extracts from the world by printing dollars, estimated to be 20 billion usd pr year according to Krugman. Basically means the US government steals 20 billion from the world by just printing money.

I heard about seignorage a couple of years ago and I think you're referring to this quote:

What is true is that the large holdings of US currency outside the United States — largely in the form of $100 bills, held for obvious reasons — represent, in effect, a roughly $500 billion zero-interest loan to America. That’s nice, but even in normal times it’s only worth around $20 billion a year, or roughly 0.15 percent of GDP.

It's certainly not insignificant, however, you should definitely read Michael Hudson's 'Super Imperialism: The Origin and Fundamentals of U.S. World Dominance' if you want an in-depth view of U.S. economic hegemony and the mechanics behind it.

There's a 3rd edition of the book that I haven't read just yet, but look into it.

Nilotic

VIP

I don't know much about the financial world..

You don't have permission to view the spoiler content. Log in or register now.

Neither do I, mate. I just thought I would share what I learned from Richard Werner and Michael Hudson.

I studied Marketing, so I'm certainly not well versed in economics and finance; I want to return to studying at uni and take up economics from people like Bill Mitchell and Steve Keen, so that I can get a real handle on all of this.

NordicSomali

VIP

there is something called 'weaponization of finance' which is the power to exclude people and crountries from financial markets.I heard about seignorage a couple of years ago and I think you're referring to this quote:

It's certainly not insignificant, however, you should definitely read Michael Hudson's 'Super Imperialism: The Origin and Fundamentals of U.S. World Dominance' if you want an in-depth view of U.S. economic hegemony and the mechanics behind it.

There's a 3rd edition of the book that I haven't read just yet, but look into it.

Nilotic

VIP

there is something called 'weaponization of finance' which is the power to exclude people and crountries from financial markets.

The United States regularly throws its economic and financial weight around and the term 'weaponization of finance' is certainly an apt description of its global conduct.

I came across two great articles on this imperial practice.

Sanctions Are Destroying U.S. Dollar's Status as World's Top Currency

"When you use this particular tool to the extent that we're using it, you can expect that it becomes more and more cost-effective for the countries that are affected to look for alternatives," Benn Steil, an economist at the Council on Foreign Relations, told Newsweek.

How the US uses global dollar payments system to impose sanctions

The US dollar’s dominance in international financial transactions gives Washington a powerful tool that it uses to sanction people and institutions on a global scale.

Last edited:

NordicSomali

VIP

you now the theories in economics is not a natural law that always works, sometimes when economists test those theories in reality they dont hold up completely, its really a social science that studies human behavior and its changing, same with finance, the field of econometrics tests the theories with real world dataNeither do I, mate. I just thought I would share what I learned from Richard Werner and Michael Hudson.

I studied Marketing, so I'm certainly not well versed in economics and finance; I want to return to studying at uni and take up economics from people like Bill Mitchell and Steve Keen, so that I can get a real handle on all of this.

Nilotic

VIP

Bank of England source on money (credit) creation:

Source:

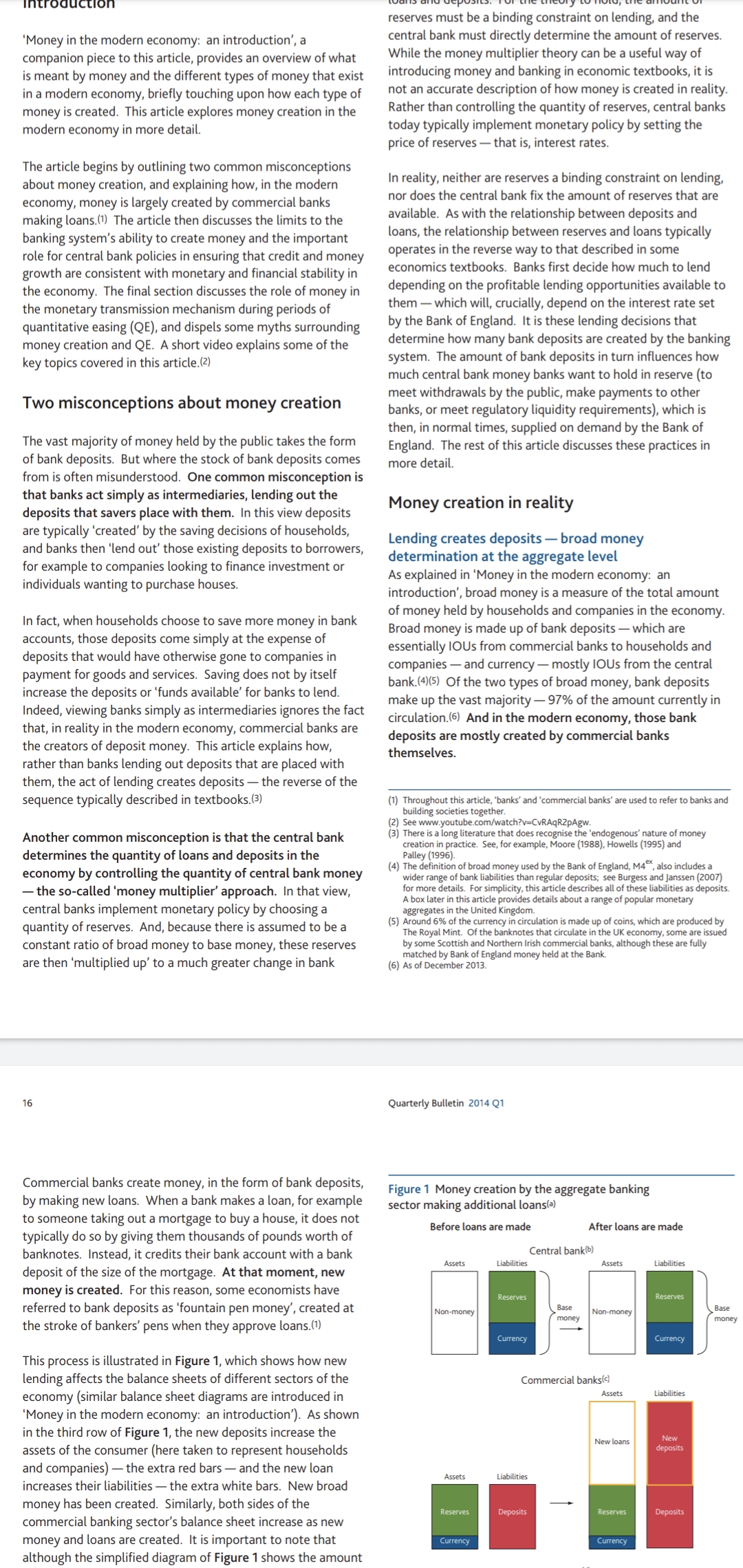

This article explains how the majority of money in the modern economy is created by commercial banks making loans. Money creation in practice differs from some popular misconceptions — banks do not act simply as intermediaries, lending out deposits that savers place with them, and nor do they ‘multiply up’ central bank money to create new loans and deposits. The amount of money created in the economy ultimately depends on the monetary policy of the central bank. In normal times, this is carried out by setting interest rates. The central bank can also affect the amount of money directly through purchasing assets or ‘quantitative easing’.

Source:

Whenever this is discussed I always see people asking why the government doesn't just print more money so poverty would magically cease to exist lol.

It's a cute kindergarten idea but

View attachment 206174

@Boqorada Where ARE YOU?

Thanks for sharing this. I always thought it was predominantly central banks that created money.Bank of England source on money (credit) creation:

View attachment 209285

View attachment 209290

Source:

Nilotic

VIP

Thanks for sharing this. I always thought it was predominantly central banks that created money.

You're welcome, mate.

Very few people know that commercial banks create 97% of the money supply through double-entry bookkeeping via credit creation.

Last edited:

I imagine there's regulations that restrict how much money a bank can create, right? Probably linked to how much capital they have?You're welcome, mate.

Very few people know that commercial banks create 97% of the money supply through double-entry bookkeeping via credit creation.

But surely money these regulations differ from country to country?

I guess it's in the bank's own good that they don't lend too much money, so they don't fail.

It is an interesting topic. I'll read into it tonight hopefully.

Nilotic

VIP

I imagine there's regulations that restrict how much money a bank can create, right? Probably linked to how much capital they have?

But surely money these regulations differ from country to country?

I guess it's in the bank's own good that they don't lend too much money, so they don't fail.

It is an interesting topic. I'll read into it tonight hopefully.

Yes, there are regulatory and market restraints on credit creation by the commercial banks.

From the same Bank of England source:

NordicSomali

VIP

banks are really greedy, if they happen to be so important that no one can allow them to fail then they could act reclessly since they wont suffer the consequences because they will get bailed.I imagine there's regulations that restrict how much money a bank can create, right? Probably linked to how much capital they have?

But surely money these regulations differ from country to country?

I guess it's in the bank's own good that they don't lend too much money, so they don't fail.

It is an interesting topic. I'll read into it tonight hopefully.

NordicSomali

VIP

The central banks have an inflation target typically of 2%. it exists because its an insurance against recessions. Economists believe in a neautral rate of interest that brings the economy to full employment, which could potentially become a negative interest rate in a recession.

Today interest rates are very low and some inflation is needed to create a negative neautral rate. So inflation is good, according to economists.

Today interest rates are very low and some inflation is needed to create a negative neautral rate. So inflation is good, according to economists.

Last edited:

I only trust xalwocoin

Nilotic

VIP

banks are really greedy, if they happen to be so important that no one can allow them to fail then they could act reclessly since they wont suffer the consequences because they will get bailed.

That's precisely why they should be turned into public utilities instead of private, for profit enterprises; their singular purpose should be to help the economy grow.

NordicSomali

VIP

Thats not a bad idea, but they still have to be profit driven otherwise a bank collapsing hurts everyone. Either way, stateowned banks dont necessarily operate differently, the difference is the gambling US banks do would be much less because the government as investor wouldnt allow that, since the government is not a risky investor.That's precisely why they should be turned into public utilities instead of private, for profit enterprises; their singular purpose should be to help the economy grow.

But investment banks should be private.

Nilotic

VIP

Thats not a bad idea, but they still have to be profit driven otherwise a bank collapsing hurts everyone. Either way, stateowned banks dont necessarily operate differently, the difference is the gambling US banks do would be much less because the government as investor wouldnt allow that, since the government is not a risky investor.

But investment banks should be private.

Strict credit guidance is precisely what's needed for the banking sector; credit should not be used for profligate, unsustainable consumption or asset bubbles.

I'll have to do more research on investment banks before I can say anything on it.

NordicSomali

VIP

Money goes where the highest return is. Asset bubbles are created because bonds have low returns, so people buy stocks to get higher returns. And thats important because insurance funds and pension funds need high returns for people to retire or pay out insurance money. And right now bonds give low returns so risky investments get more money and that creates bubble.Strict credit guidance is precisely what's needed for the banking sector; credit should not be used for profligate, unsustainable consumption or asset bubbles.

I'll have to do more research on investment banks before I say anything on it.

This is actually what created the financial crisis (part of it). The federal reserve lowered insterest rates and bonds returns got low, so investors started looking for riskier investments and that created a bubble. Right now we also have a bubble because interest rates are low.