codewebsduh

VIP

In our previous piece, Link, we discussed the lack of diversification evident within the Somali export market and its consequent impact. Today we will briefly view our animal-based export market.

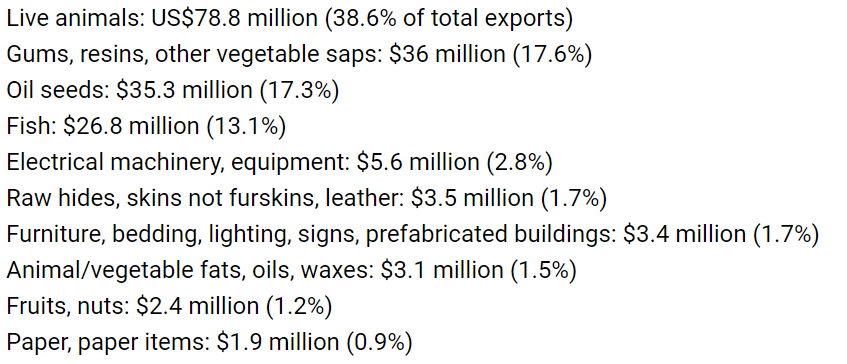

Below is a quick overview of the top 10 Somali (2019) exports.

2019 Somalia Export Market(controversial)

As we can see, Somalia heavily relies on live animal exports. A substantial amount of these exports is sold to Gulf countries such as Saudi Arabia, UAE, Yemen, and Oman. This inadvertently yields an economic security risk for Somalia, whereby disgruntled Arab nations can use live animal exports as leverage for their national interests.

Below we discuss some methods Somalia can implement to optimize its animal-based export market.

Market Expansion:

There is an estimated 40 million livestock within Somalia and growing. Most of this livestock is held by nomads who only return to the cities to sell their produce or export to foreign markets. Due to the purchasing parity within Somalia, Somali livestock is cheaper and easily undercuts the foreign livestock market. This was seen through the solidification of the Arabian market from 1994 to 2013, resulting in Somali exporters overtaking the 2million/year gulf Australian export capacity.

However, due to the lack of export country diversification, Somalia suffers whenever the Arabian market limits livestock imports(example). Thus for a more safe and solid livestock market, Somalia needs to focus on new markets.

This expansion will naturally occur through the profit-seeking nature of the individual, but it can be accelerated through governmental led international exhibitions. For instance countries such as Turkey, the USA, China, and Russia import millions of cattle per year to feed their population. Breaking into those markets and undercutting competition would afford Somalia a more secure export sector.

Reduction in Live Animal Exports:

The live animal export, unfortunately, is one of the most inefficient methods of meat transfer. The risk of a disease proliferation in ship conditions is extremely high causing thousands of animals to die every year. Due to the socioeconomic background of livestock owners, they often cannot offset this cost.

One avenue for Somalia to increase ROI is the refinement of the meat packaging meat sector. Due to limited investment, the current meat packaging sector primarily involves open warehouses that don’t practice any quality assurance methodologies nor produce a consistent amount of meat. The latter due to a lack of consistent electric power.

To improve on this, a new facility would need to abide by stringent temperature requirements. This would involve the development of a heavily insulated hanger with focused chilled air cold pumps. However, due to electricity requirements, the facility must be large to offset inherent costs or invest in private electricity generators.

Furthermore, the facility will need an assembly room to separate the meat into its proper components. Said meats would also need to be packaged in plastic and branded before exporting to the larger world market.

Such a facility or facilities will offer a higher ROI for both the facility owner and livestock owners. It will also provide effective employment for thousands of Somalis which imply the export profits transverse more effectively throughout the community.

Non-Meat based animal products:

Somalia can also benefit from investing in a non-meat based animal products. Several sectors that could be of interest are:

Somalia currently has a $3.5 million, export-based, tannery industry lead by the Bosaso tannery in the North East of Somalia. This could be expanded with tanneries being developed in livestock rich southern cities.

- Raw hides, skins, and leather

- Animal fats, oils, and waxes.

- Dairy sector.

Somalia also suffers from a $116million trade deficit in Animal/vegetable fats, oils, and waxes. Which suggests a strong internal demand for said goods, a Somali based producer could offset this trade deficit and eventually export to other countries.

Finally, Somalia heavily relies on the importation of powdered milk due to an infantile milk industry. Investment in machinery, importation of dairy cows, and educating the populace of milk handling methodologies could reduce the reliance on powdered milk and allow the eventual exportation of Somali produced milk.

Luckily, we are already seeing entrepreneurship in the milk industry. One example is the creation of Irman dairy milk factory in Mogadishu. Said plant has a production capacity of 10,000 liters per day but only produces 2000 liters per day due to constraints.

Conclusion:

This was a brief explanation of how Somalia could further expand its animal-based export market.

Next time we will discuss the mining industry within Somalia and how it can kick-start the development of Somalia.

Origin:

Link