This has been on my mind for a while.

At first glance 90% recovery cost seems very bad but when you realize that it means they will earn back their investment in less than 5 years it starts to sound better

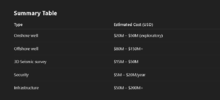

Assuming the cost per block would be around 2B$

And that the exploration (which is at 75% as of now) would end by the end of this year, the planning would take until 2027 and the development and drilling would take until the first few years of the next decade (approx. 2031)

This means that we would owe TPAO 2B$ x 3 blocks = 6B$

If each block generates at least 550M$/a year, 3 generate 1.5b$ a year and TPAO takes 90% (1.35B$) that would mean it would only take us a record time of 5 years or less for TPAO to earn back their $6 billion at that rate.

But that's not all, if I recall correctly we still get 10% during these few years, which is approx. 150M$ a year for max. 5 years.

150M$ is a huge number for Somalia. Correct me if I'm wrong but the FGS in all its history has never put that much money on the table for any projects. To put it into perspective, 100M$ could build around 5 modern and fully equipped hospitals throughout the country. With a 100M$ they could also build about 475 primary schools fully equipped with textbooks for all students. These are the two sectors holding our HDI back and that seriously need attention.

I'm not very sure about this, but I also think there are laws to share oil revenues between the several federal states. So if the Federal Gov keeps 50M, that still leaves 15M$ for each state (Jubaland, Hirshabelle, Galmudug, Puntland)

Also I don't know if it's a coincidence, but the dates when they start building the new Mogadishu airport and economic zone could match the first barrel drilled ?

Considering everything Turkey has built for Somalia, this isn't a bad deal. I'll admit the part where they say that Somalis can't oversee the operation is a bit sketchy but the Somalis mad at the contract because any disagreement would be disputed at a UN court in Turkey is just dumb, Turkey also had to go to the US when they had a disagreement about the F35s. The fact that they wont hire any Somalis also makes sense, good luck finding a significant Somali workforce trained for this. We also have to consider the fact that we are currently seen as a poor and highly unstable state nobody wants to risk investing in.

With all this into account, the contract would obviously not be fully in our favor.

If this deal goes well it will attract even bigger foreign investments to tap into oil, gas and other natural resources. Pretty sure Shell and two other american companies are watching from the sidelines and waiting for their turn. I saw somewhere that the Americans reserved 7 offshore blocks.

I know some of you will call me biased but I'm looking at this from a neutral perspective, I'm not even very fond of the FGS nor Turkey. To summarize, I see more pros than cons in the recent Turkish oil deal.

Am I the only one to see it like this ? What do you guys think ?

At first glance 90% recovery cost seems very bad but when you realize that it means they will earn back their investment in less than 5 years it starts to sound better

Assuming the cost per block would be around 2B$

And that the exploration (which is at 75% as of now) would end by the end of this year, the planning would take until 2027 and the development and drilling would take until the first few years of the next decade (approx. 2031)

This means that we would owe TPAO 2B$ x 3 blocks = 6B$

If each block generates at least 550M$/a year, 3 generate 1.5b$ a year and TPAO takes 90% (1.35B$) that would mean it would only take us a record time of 5 years or less for TPAO to earn back their $6 billion at that rate.

But that's not all, if I recall correctly we still get 10% during these few years, which is approx. 150M$ a year for max. 5 years.

150M$ is a huge number for Somalia. Correct me if I'm wrong but the FGS in all its history has never put that much money on the table for any projects. To put it into perspective, 100M$ could build around 5 modern and fully equipped hospitals throughout the country. With a 100M$ they could also build about 475 primary schools fully equipped with textbooks for all students. These are the two sectors holding our HDI back and that seriously need attention.

I'm not very sure about this, but I also think there are laws to share oil revenues between the several federal states. So if the Federal Gov keeps 50M, that still leaves 15M$ for each state (Jubaland, Hirshabelle, Galmudug, Puntland)

Also I don't know if it's a coincidence, but the dates when they start building the new Mogadishu airport and economic zone could match the first barrel drilled ?

Considering everything Turkey has built for Somalia, this isn't a bad deal. I'll admit the part where they say that Somalis can't oversee the operation is a bit sketchy but the Somalis mad at the contract because any disagreement would be disputed at a UN court in Turkey is just dumb, Turkey also had to go to the US when they had a disagreement about the F35s. The fact that they wont hire any Somalis also makes sense, good luck finding a significant Somali workforce trained for this. We also have to consider the fact that we are currently seen as a poor and highly unstable state nobody wants to risk investing in.

With all this into account, the contract would obviously not be fully in our favor.

If this deal goes well it will attract even bigger foreign investments to tap into oil, gas and other natural resources. Pretty sure Shell and two other american companies are watching from the sidelines and waiting for their turn. I saw somewhere that the Americans reserved 7 offshore blocks.

I know some of you will call me biased but I'm looking at this from a neutral perspective, I'm not even very fond of the FGS nor Turkey. To summarize, I see more pros than cons in the recent Turkish oil deal.

Am I the only one to see it like this ? What do you guys think ?