London house prices fell 1 per cent on the year in February, the first such price drop in more than eight years and the latest sign of weakness in the capital’s property market. “London has shown a general slowdown in its annual growth rate since mid-2016,” the UK Office for National Statistics said on Wednesday. The country’s official statistics agency said the 1 per cent decline from the same time a year ago was the lowest reading since September 2009, when prices fell at a year-on-year rate of 3.2 per cent.

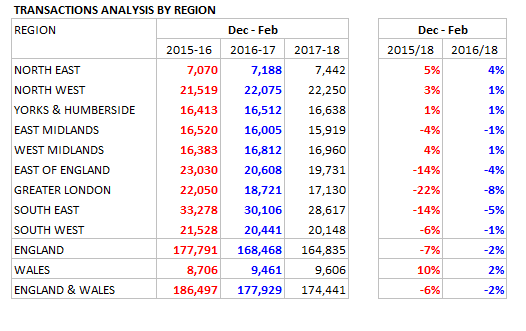

The data underline the contrasting fortunes of property owners in England’s largest city and the regions. The second-slowest growth rate for the year to February — in Yorkshire and the Humber — was a rise of 3.1 per cent. Prices in every region apart from London grew, with a majority adding more than 4 per cent to their property values. House prices in England grew 4.1 per cent overall — slightly below the UK figure of 4.4 per cent.

UK house price growth slowed from January, when it came in at 4.7 per cent year-on-year. London faced a particularly dramatic reversal. Prices in the city had risen 1.3 per cent in the year to January, before February’s annual drop. “The official measure of house price growth has begun to register the slowdown reported by other, timelier measures,” said Samuel Tombs, chief UK economist at Pantheon Macroeconomics.

Other indicators suggested that worse was yet to come, Mr Tombs added. “The official measure lags because it is based on completed transactions, rather than mortgage offers or asking prices.

Data from the Nationwide, Halifax, Rightmove and RICS all suggest that the official measure will slow further, to about 2 per cent, over the coming months.” On top of that, the capital’s homeowners would likely be worse hit by other economic changes, such as increases to mortgage rates if the Bank of England raises interest rates as expected. “Further increases in mortgage rates over the coming months likely will have a greater impact on prices in London than in the rest of the U.K., given that loan-to-income ratios are much higher in the capital,” he said.

https://www.ft.com/content/451076e0-42ea-11e8-803a-295c97e6fd0b

The data underline the contrasting fortunes of property owners in England’s largest city and the regions. The second-slowest growth rate for the year to February — in Yorkshire and the Humber — was a rise of 3.1 per cent. Prices in every region apart from London grew, with a majority adding more than 4 per cent to their property values. House prices in England grew 4.1 per cent overall — slightly below the UK figure of 4.4 per cent.

UK house price growth slowed from January, when it came in at 4.7 per cent year-on-year. London faced a particularly dramatic reversal. Prices in the city had risen 1.3 per cent in the year to January, before February’s annual drop. “The official measure of house price growth has begun to register the slowdown reported by other, timelier measures,” said Samuel Tombs, chief UK economist at Pantheon Macroeconomics.

Other indicators suggested that worse was yet to come, Mr Tombs added. “The official measure lags because it is based on completed transactions, rather than mortgage offers or asking prices.

Data from the Nationwide, Halifax, Rightmove and RICS all suggest that the official measure will slow further, to about 2 per cent, over the coming months.” On top of that, the capital’s homeowners would likely be worse hit by other economic changes, such as increases to mortgage rates if the Bank of England raises interest rates as expected. “Further increases in mortgage rates over the coming months likely will have a greater impact on prices in London than in the rest of the U.K., given that loan-to-income ratios are much higher in the capital,” he said.

https://www.ft.com/content/451076e0-42ea-11e8-803a-295c97e6fd0b